For Managed Service Providers (MSP’s), often times, managing company finances comes second to managing client success. Enter Next Level Now – a trailblazing financial transformation firm whose controllers, CFOs, and accountants are not only adept at their craft but have…

Read MoreNext Level Now has been working intimately with ABA providers using ABA data collection software for years, providing financial consulting and hands on work with their transactional accounting systems. CentralReach is the go-to system for ABA providers, and Next Level…

Read MoreWe are excited to announce the launch of our brand new website at Next Level Now! As your trusted financial advisory partner, we strive to stay at the forefront of innovation to better serve our clients. While our website may…

Read MoreRunning a successful business requires efficient financial management. Because of this, many executives employ support to ensure accurate bookkeeping, timely tax filings, and insightful financial analysis. When it comes to managing such finances, there are two options: utilizing outsourced accounting services or…

Read MoreIt is not unusual for early-stage companies to lack a finance chief or other financial professionals, as their primary focus is often on growth. Some startups depend on their venture-capital investors or banks for financial guidance. While there is no…

Read MoreCreating a budget is an important part of running a successful business. However, creating a budget or company financial plan can be difficult. That’s where Next Level Now comes in; our outsourced financial services will help you get your spending…

Read MoreJoe Peppard, Principal Research Scientist for MIT’s Sloan School of Management published this article in the Wall Street Journal. In the article, he argues that businesses should consider getting rid of their IT department. While IT helps companies stand out…

Read MoreThe dedicated employees of Next Level Now met in Portsmouth, NH from September 12-16th for the company’s annual “Dream Team Week”. Dream Team Week is a company meet-up for both work and play. The team got together in Portsmouth, NH…

Read MoreAs a small Managed Security Services Provider, 1440 Security could not afford a full-time CFO or controller. Their CEO was performing many of those functions, while an office manager/bookkeeper was handling Accounts Receivable and Payable with QuickBooks. Once they learned…

Read MoreHanding over your company’s financial books and records to a firm can sometimes be intimidating. You’ll want to make sure the outsourced accounting firm is trustworthy and dependable. Plus, there are other qualities that you’ll want to identify beforehand. To…

Read MoreEvery business, at one time or another, experiences either tremendous growth or tremendous uncertainty. During these moments, it’s important that they rely on a trustworthy CFO for success. Learn why breaking away from traditional in-house bookkeeping and accounting services can…

Read MoreAccounting technology has transformed the profession entirely. Now, complex audits and financial processes are more accurate and efficient than ever before thanks to automations and innovations. Discover the key financial technologies that we recommend and how they can help your…

Read MoreA little while back, we were working with a client that had to close its doors. It sucked for us, it sucked for management, it sucked for the employees, and it sucked for the board and the investors. As we…

Read MoreProfessional Service Organizations (PSOs) often face a distinct array of challenges to foster success and growth. And predictability is key in ensuring that you meet stakeholder’s expectations to support the goals of your organization. Learn how to create a profitable…

Read MoreNext Level Now will be attending a variety of conferences this year to network, learn, and take part in the ever-evolving discussions around finance, applied behavior analysis, and information technology. We are excited to see everyone virtually and in person!…

Read MoreThe COVID-19 pandemic caused many businesses’ sales pipelines to dry up. So, our CEO Ken Peterson spoke with John Barrows, CEO of JBarrows Sales Training about how businesses can get back on track in a post-pandemic world. Restocking Your Business’…

Read MoreThe first event of 2020 kicked off on January 29 at Grill 28/Pease Golf Course. The Executive Series Moderator/CFO, Matt Towse welcomed our guest panel of Brandi Bonds, CFO at Next Level Now, John-Michael Girald, Founder of Peloton Advisory, Julie…

Read MoreWe are happy to bring a new business series to the Seacoast. The Executive Series – learning and networking event. Our inaugural event kicks off with an interactive talk with a Panel of M&A professionals. Our inaugural event starts off…

Read MoreA client’s controller had resigned from their already understaffed accounting department. They were in urgent need of help and reached out to us for assistance. Learn how our outsourced CFO services helped them recover and thrive. Key Points: Problem: The…

Read MoreTax season can be long and hard for CPA firms. In honor of all the hard work, we decided to bring a party to our friends at Nathan Wechsler & Company to celebrate all their great work on behalf of…

Read MoreThe Turnaround Management Association – Northeast Chapter presented an in-depth look at Challenging Times for some US Beer Companies, March 7, 2019 at Rising Tide Brewery, Portland Maine. Panelists; Brandi Bonds, CFO – Next Level Now, Dan Sklar, Partner –…

Read MoreWe are always looking for ways to leverage technology to streamline financial processes and help our clients SOAR. CFO leaders, Brandi Bonds and Kenneth Peterson are attending Digital CPA 2018 in Washington DC this week. DCPA is the leading conference…

Read MoreThe week is starting off well with a front-row seat to hear Dag Kittlaus speak at Digital CPA 2018. Dag is the co-founder and CEO of Viv, the global brain. Prior, he founded Siri (acquired by Apple in 2010).

Read MoreCFO Brian McGettrick is a Boston native and true New England sports fan through and through. He enjoys tennis, golf and running many 5Ks that benefit our communities. You will not find a more patient and dedicated CFO who is not afraid…

Read MoreKudos to our client Constellations for expanding their applied behavior analysis services to the state of Massachusetts. They show a great commitment to the community and to the children they work with every day.

Read MoreAs wellness continues to grow as one of the leading trends in the workplace, our client Workbar, a Boston-based coworking brand, has taken an extra step to further its commitment to wellness and create a human-focused workspace. Workbar recently opened…

Read MoreThomas Edison once said, “There’s a way to do it better – find it.” Always learning with a drive to do things better is why CFO and Leader Kenneth Peterson is attending the Digital CPA Conference. DigitalCPA.com

Read MoreWe are happy to announce, Lori Decato Metz, our Marketing Manager, has been accepted and will participate in Seth Godin’s altMBA January 2018! Learn more about altMBA here.

Read MoreCongrats to our friends at Orion Entrance Control, Inc. on the launch of their new website! Orion is a NH-based, family-owned, global provider of optical turnstile solutions.

Read MoreWe congratulate our NH technology client Akumina. In the news again about their latest software release. “What Akumina built in this latest release is what the Microsoft community has been waiting on for years. The ability to provide different experiences…

Read MoreKenneth Peterson, founder and president of Next Level Now is presenting a talk about best financial practices to eliminate seasonality in businesses at the National Propane Gas Association’s Benchmarking Council in West Palm Beach Florida, January 12, 2017.

Read MoreThe Next Level Team enjoyed a special night out at the amazing Share Your Love Dinner Thursday, Feb 11, 2016 at the Atlantic Grill in Rye. NLN has been proud to support this great community event and has made it the company…

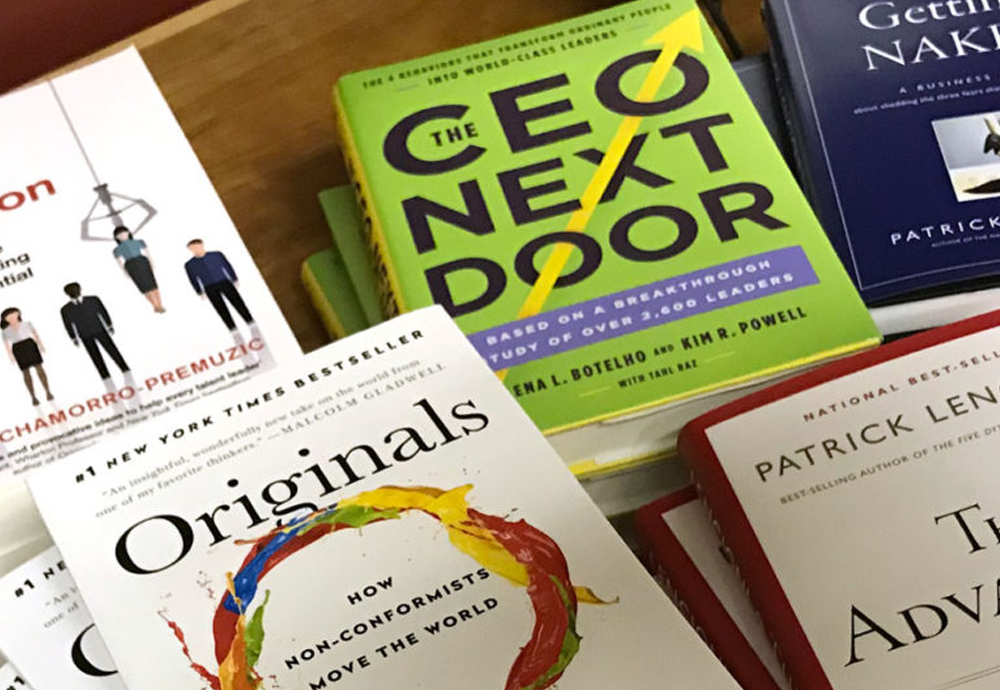

Read MoreKnowledge is Power. It controls access to opportunity and advancement. – Peter Drucker We enjoy reading and recommending books to our clients. Below is our ever-growing list of favorites: The Daily Drucker, Peter F. Drucker The Ecological Vision, Peter F. Drucker Good…

Read More